PARTIZIPIERE AM WACHSTUM DES GLobalen ONLINE HANDELS

Der Global Online Retail Fonds ist der

E-Commerce Aktienfonds für Privatanleger & Profis. Er basiert auf dem Aktienindex GLORE50, der seit 2015 die Performance des globalen Online Handels abbildet.

WERTPAPIER KENNNUMMER (WKN) A14N9A

PARTIZIPIERE AM WACHSTUM

DES GLobalen ONLINE HANDELS

Der Global Online Retail Fonds ist der E-Commerce Aktienfonds für Privatanleger & Profis.

Er basiert auf dem Aktienindex GLORE50, der seit 2015 die Performance des globalen Online Handels abbildet.

WERTPAPIER KENNNUMMER (WKN) – A14N9A

Investieren in den E-commerce

+ niedrige Gebühren <0,99% + volle Transparenz

Investiere dort, wo Du einkaufst,

was Du selber nutzt und als Kunde verstehst!

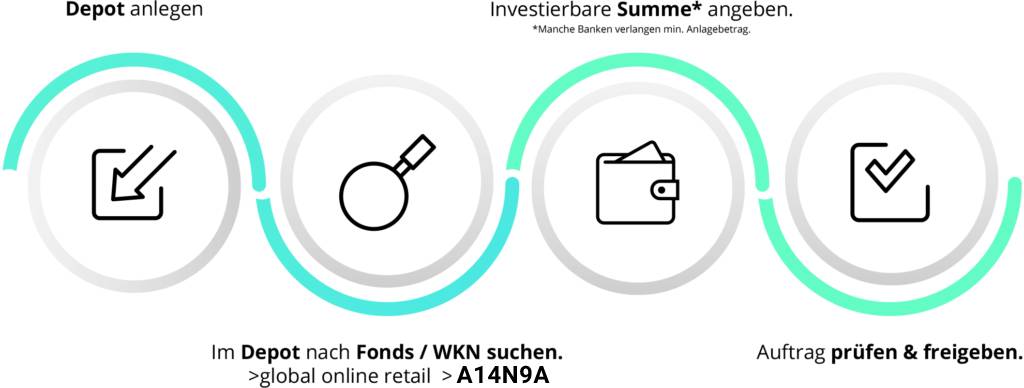

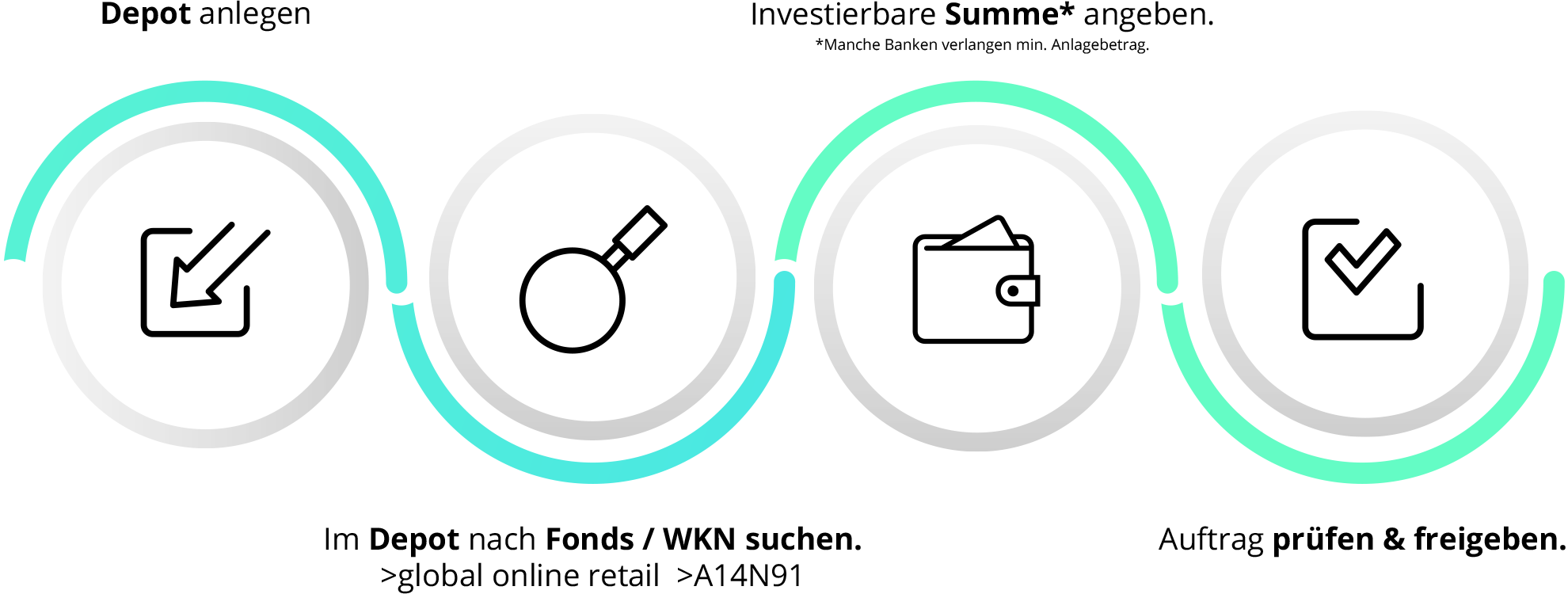

Wie investiere ich?

Es ist einfacher als Du denkst. Du bist der Schöpfer Deiner finanziellen Unabhängigkeit.

WKN vom Global Online Retail Fonds: A14N9A

Wie investiere ich?

Es ist einfacher als Du denkst. Du bist der Schöpfer Deiner finanziellen Unabhängigkeit.

Die Investoren

Die Initiatoren

Glore Monthly

Erhalte jeden Monat unverbindlich Highlights

und Updates über den GLORE Index.

Glore Insights

Der Podcast zum globalen

E-Commerce BörsenIndex.

Glore Monthly

Erhalte jeden Monat unverbindlich Highlights und Updates über den GLORE Index.

Glore Insights

Der Podcast zum globalen

E-Commerce BörsenIndex.

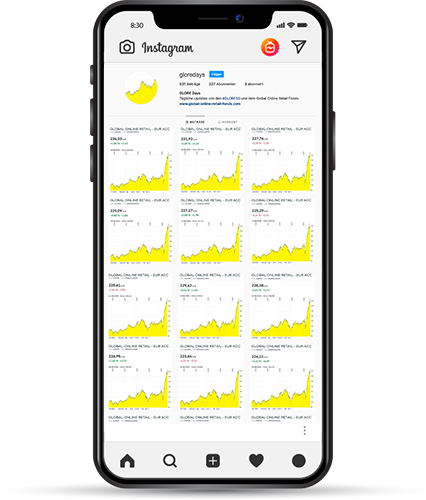

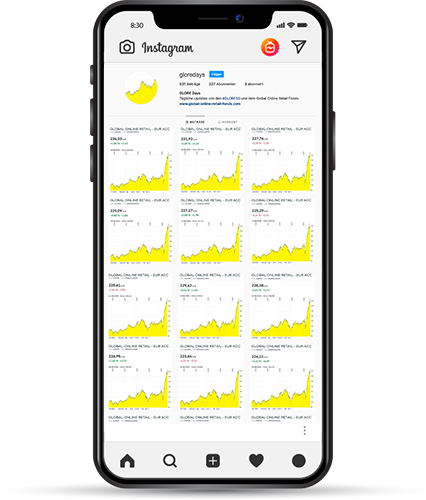

Glore Days

Tägliche Kurs Updates

findest Du auf Instagram.

Glore Presse

News rund um den

Global Online Retail Fonds.

Glore Days

Tägliche Kurs Updates

findest Du auf Instagram.

Glore Presse

News rund um den

Global Online Retail Fonds.

FONDS MANAGER

ASSET SERVICES

ASSET ALLOCATION

FONDS RESEARCH

FONDS MANAGER

ASSET SERVICES

ASSET ALLOCATION

FONDS RESEARCH